TDS Interview Questions

Following is the list of important questions for TDS interview.

You can also study accounts and taxation at teachoo.com

Content prepared by Chartered Accountant and updated daily

TDS Interview Questions

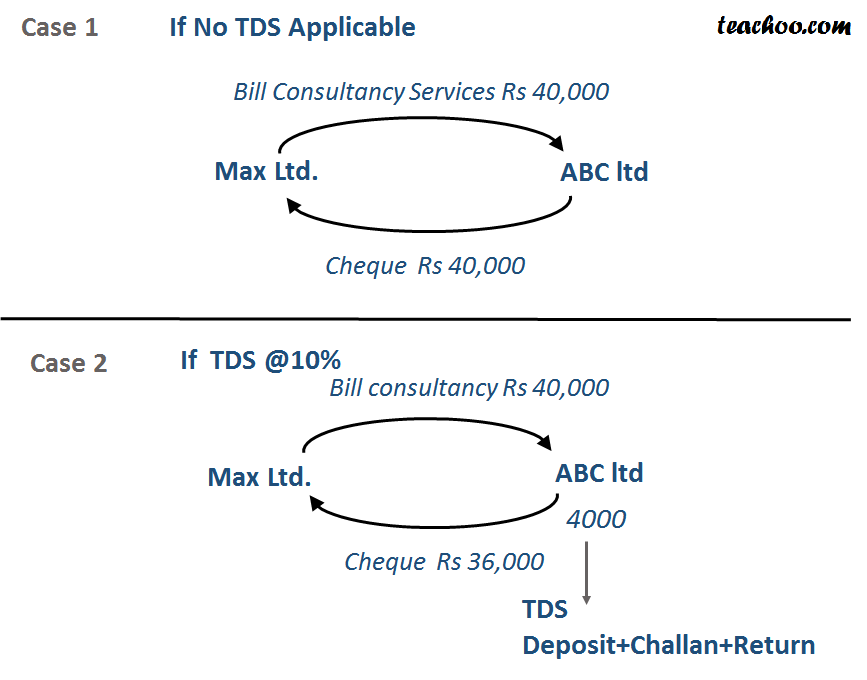

What is TDS?

TDS means Tax Deducted at Source.

It is a tax which is to be deducted on some expenses and payments

As per Income Tax Act, persons responsible for making payments are required to deduct TDS at different rates.

Why is TDS Deducted??

Source of Income of Max is Amount to be received by ABC

Tax has been deducted at this source by ABC

https://www.teachoo.com/942/364/Meaning-of-TDS-(Tax-Deducted-at-Source)/category/What-is-TDS/

What are Important Rates of TDS?

Important Sections TDS Chart (From 1st June 2016)

|

Section no |

Description |

Cutoff |

Rate of TDS |

Examples |

|

194I |

Rent of |

180000 p.a |

10% |

Office rent /godown rent/guesthouse rent |

|

Land and Building or Furniture |

||||

|

Others like Plant and Machinery |

2% |

Generator rent, machinery hire charges |

||

|

194J |

Professional Service/Technical/Royalty/Non Compete fees |

30000 p.a |

10% |

Audit fees/Bills of professionals like CA/CWA/CS, or technical service providers or consultancies covered. Employees on contract which are white collared covered here |

|

194H |

Commission/Brokerage |

5000 p.a 15000 p.a |

10% 5% |

Commission to broker/sales agent etc |

|

194J(1)(b)(a) |

Payment to directors other than salary |

0 |

10% |

Sitting fees to director/any payment other than salary |

|

194A |

Interest paid by Banks on FD/RD |

10000 p.a |

10% |

Savings bank interest not covered, only interest on fixed deposits and recurring deposits covered |

|

194 A |

Interest paid by Others on Loan etc |

5000 p.a |

10% |

Interest on loan taken from banks or financial institutions not covered, only interest on loan from friends/relatives/related companies covered |

|

194 IA |

Purchase of Immovable property |

4999999 |

1% |

On purchase of property more than 50 lacs, buyer has to deduct 1% and pay balance to party |

|

194C |

Payment to Contractors |

30000 Single Contract or 75000 100000 annual |

1% for Individual and HUF (2% For Others like Partnership, Company) |

All other services like payment to Security guard/courier/maintenance agency/cab service/advertisement/employees on contract which do blue collared or manual work like peon/driver etc |

|

192A |

Withdrawal of Pf before 5 Years |

30000 50000 p.a |

10% |

If we withdraw our PF for before 5 years, then Pf department deduct 10% TDS. |

If Rent is 15000 pm, do we need to deduct TDS?

Total Rent paid during year = 15000*12 = 180000

No TDS to be deducted as Total rent paid during year is not more than 180000

Is TDS Deducted on GST Component?

No

TDS is deducted on amount before GST

Example:-

What is TAN Number?

It means Tax Deduction Account number

In eassy language, it is TDS registration number.

We need to mention this number, while filing TDS challan and Return

What are TDS Certificates and its due dates?

TDS Certificate is of 2 types

- Form 16A for TDS NON SALARY

(to be given quarterly 15 days of due date of TDS Return)

- Form 16 for TDS SALARY

(to be given annually by 31 May of next year)

How to File TDS Return?

TDS Return Basically Contains following types of Details

-

Deductor Details

(Details of Our Company who is filling TDS Return)

-

Challan Details

(Details of Monthly TDS Challans which we have filed)

-

Deductee Details Challan vise

(Details of Different Parties whose TDS we have deducted in one challlan)

Note:-

It is normally done through some TDS Return Software

Some of these softwares are Paid while Government also provides a free software called RPU (Return Preparation Utility)

https://www.teachoo.com/955/369/Procedure-for-TDS-Return/category/Return-Procedure/

How to Revise TDS Return?

Conso file is to be downloaded in case we need to revise TDS Return.

First we have to download this file from traces and then imported into software to generate TDS Return

What is the website of TDS?

There are two websites.

1. TRACES

https://www.tdscpc.gov.in/app/login.xhtml

This website is use for downloading TDS certificate, Downloading Conso file and Justification report

2. INCOME TAX INDIA WEBSITE

https://www.incometaxindiaefiling.gov.in/home

This website is use to upload TDS Return

How much interest on late payment of TDS?

1.5% interest pm for minimum 2 months

How much interest on late deduction of TDS?

1% interest from due date of deduction to actual rate of deductions

What is TDS Conso file?

This file is to be downloaded in case we need to revise TDS Return.

First we have to download this file from traces and then imported into software to generate TDS Return

What are statutory compliance of TDS?

TDS CHALLAN

TDS Challan Due Date

(7th of Next Month except March)

| Month | Challan 281 |

| Jan | 07-Feb |

| Feb | 07-Mar |

| March | 30-Apr |

| April | 07-May |

TDS RETURN

TDS Return Due Date

(31 Days from end of quarter except March)

| TDS Returrn | FORM 26Q/27Q | FORM 24Q | |

| TDS Non Salary | TDS Salary | ||

| Q1 | Apr-June | 31-Jul | 31-Jul |

| Q3 | Jul-Sep | 31-Oct | 31-Oct |

| Q3 | Oct-Dec | 30-Nov | 30-Nov |

| Q4 | Jan-Mar | 31-May | 31-May |

TDS CERTIFICATE

TDS Certificate Due Date

(15 Days from Return Filing Date)

| FORM 16A | FORM 16 | ||

| TDS Non Salary | TDS Salary | ||

| Q1 | Apr-June | 15-Aug | 15-Jun |

| Q3 | Jul-Sep | 15-Nov | |

| Q3 | Oct-Dec | 15-Dec | |

| Q4 | Jan-Mar | 15-Jun |

How is TDS Different from TCS?

| TDS | TCS |

| It is deducted on various expenses | It is collected on various income |

| Example:- Rent, professional services , contract payment etc. | Example:- Sale of scraps, sale of jewellery etc |

| )Return form is form 24Q salary, 26Q for non salary and 27Q for non resident (non salary | Return form is 27EQ |

| TDS certificate is form 16 for salary and 16A for non salary | TCS certificate is form 27D |

Is TDS Direct Tax or Indirect Tax?

TDS is under income tax, act which is a direct tax.

However, it is deducted from other parties, so it is of the nature indirect tax

What are 15G and 15H Forms?

These forms are given in case we want that TDS should not be deducted on our bank interest.

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year

In case we want bank not to deduct TDS, we can submit 15G form

| 15 G | 15H |

| 15 G Form is for individual less than 60 years | 15 H is for senior citizen |

| Total interest Income is less than exemption limit for that year which is Rs. 250000 | N/A |

| Tax calculation on total income is Nil | Tax calculation on total income is Nil |

What is Form 15CA 15CB Forms?

These forms are required in case of foreign payments

Earlier,these forms used to be filled for import fo goods and services both

Now,these are required to be filled only in case of services(now they are not to be filled for goods)

Procedure

When Foreign Invoice is to be Paid,bill is first sent to Chartered Accountant

Chartered Accountant checks Rates as per Income Tax and Rates as per DTAA and issues Form 15CB

This is filed online at income tax website by using his digital signature

On basis of 15CB,Company have to fill Form 15CA using directors digital signature

(In many companies,Chartered Accountant fills both forms 15CB and 15CA)

How to Learn TDS Return Filing Practically on TDS Software?

If you see any accounts job on Naurki or Monster,it requires knowledge of Tax Deducted at Source which is commonly called TDS

TDS Practical Work includes Deducting TDS on various bills as per applicable rates,Making TDS Computation,Filing TDS Returns 26Q,24Q,27Q and Issue of TDS Certificares Form 16 and Form 16A Fiing of TDS Returns is done with the help of TDS Software .Free Government Software is available at....

Some companies use private softwares like Compu TDS, Saral TDS,Webtel TDS Sofware to file return

This work cannot be learnt by reading books or watching videos on youtube. For this you can join CA Maninder Singh pracical training classes at Delhi and Pune where you would be given different data and assignments and made to file TDS Returns,Prepare TDS Challans and Computations.You will also be taught how to upload this TDS Return using digital signatures at incometaxindiaefiling website.You will also learn how to use TRACES Website to download TDS Certificate,Justification Report.Also you will learn how to correct mistakes in return by downloading conso file.

How is TDS in GST Different from TDS in income Tax?

|

TDS in Income Tax |

TDS in GST |

|

Rate of TDS Under 194C Payment to Individual /HUF 1% Payment to Others 2% |

Rate of TDS Tds Rate is 1% in all cases

|

|

Applicable only If Deductor is Covered in Tax Audit (Individual/HUF/Partnership having turnover>1 Cr Or Company )

|

Applicable in Case of

|

|

Cut off limit 30000 Single Payment Or 100000 Annual |

Cut off limit 250,000 Single Contract

|

|

Challan payment Due date is 7th of next month However, for March, it is 30 April |

Challan payment

Due date is 10th of next month (Even for March, it is same) |

|

TDS Return It is to be file quarterly one month from end of quarter Except last quarter April-June->31 July July-Sep->31 Oct Oct-Dec->31 Jan Jan-March->31 May

Form No Prescribed is Form 26Q |

TDS Return It is to be file monthly by 10th of next quarter Form No Prescribed is GSTR 7

|

|

TDS Certificate It is to be issued quarterly 15 days of filing TDS Return In case of late payment, Penalty applicable is 100 per day

|

TDS Certificate It is to be issued Monthly 5 days of filing TDS Challan In case of late payment, Penalty applicable is 100 per day Upto max 5000 |

About the Author