GST Interview Questions at teachoo (टीचू)

Following is the list of important questions for GST interview.

You can study them now or download it free

You can also study accounts and taxation at teachoo.com

Content prepared by Chartered Accountant and updated daily

GST Interview Questions

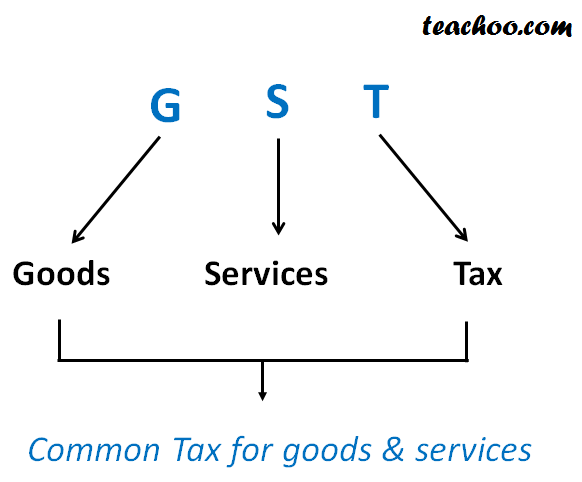

What is GST?

GST means Goods and Services Tax

It is a tax which is to be soon introduced in India

Why is GST being Introduced?

In each state of India,taxes and rules are different

GST will lead to same rates of tax on different state

When will GST be Introduced?

It is likely to be introduced by 1 July 2017

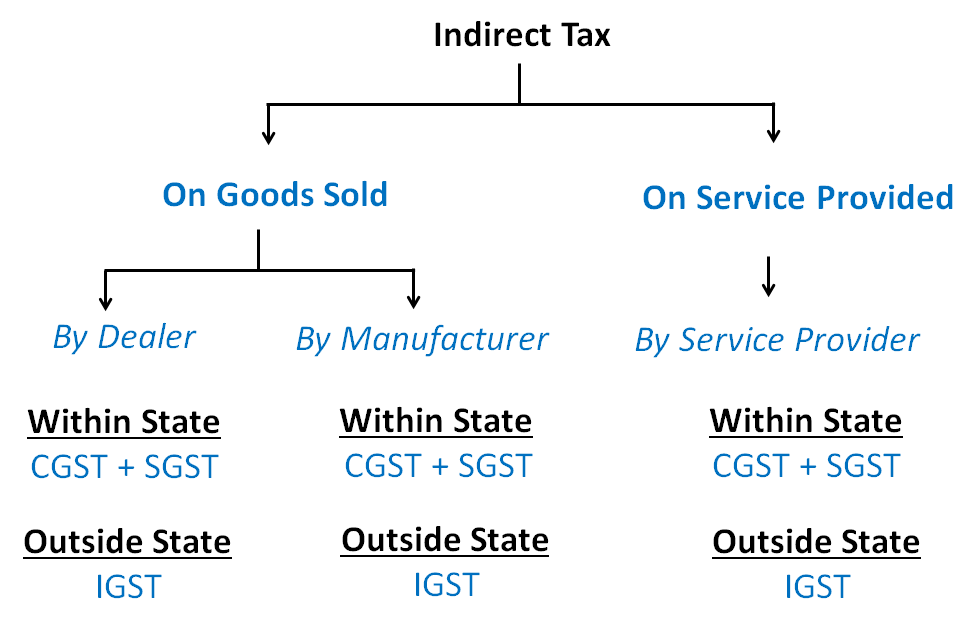

How many Different Types of GST ?

There will be 3 Different GST's

- CGST (Central GST)

- SGST (State GST)

- IGST (Integrated GST)

What are the Difference between CGST, SGST and IGST?

| CGST | SGST | Integrated GST (Interstate GST) |

Full form of CGST isCentral Goods and Services Tax |

Full form of SGST isState Goods and Services Tax |

Full form of IGST isInterstate Goods and Services Tax |

CGST will also be charged on Local Sales within State |

SGST will also be charged on Local Sales within State |

IGST will be charged on Central Sales (Sales Outside State) |

It will be charged and collected by Central Government |

It will be charged and collected by State Government |

It will be charged and collected by Central Government on Interstate Supply of Goods and Services |

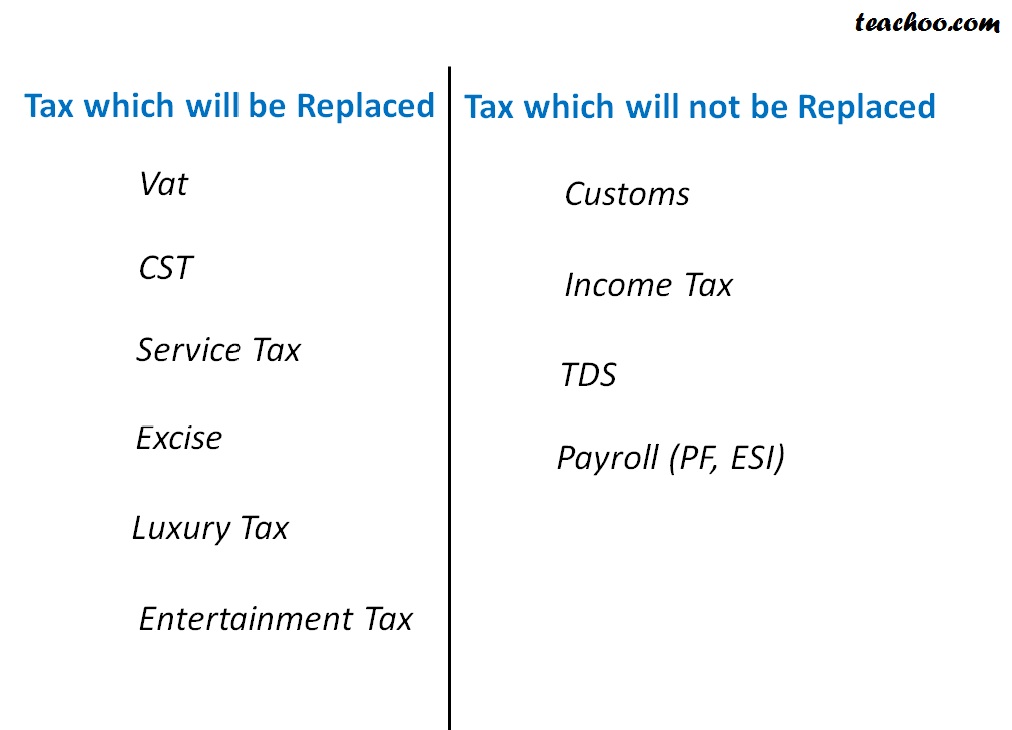

It will replace taxes like Central Excise and Service tax |

It will replace taxes like VAT, Luxury tax and Entertainment tax |

It will replace taxes like CST(Central Sales Tax) |

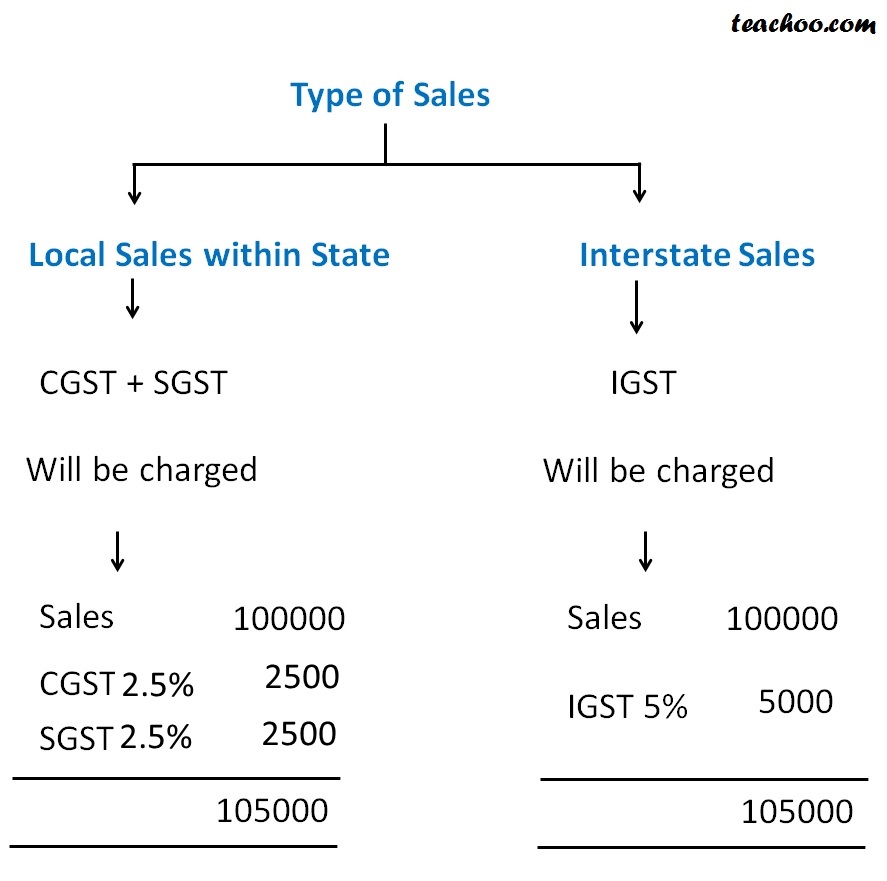

Which Type of GST on Local Sales?

CGST + SGST

Which Type of GST on Central Sales?

IGST

What are the important Benefits of GST?

-

No Tax on Tax in Case of GST.

Previously Excise wass charged on Amount

VAT/CST was charged on Amount+Excise.

After GST, both Central and State GST will be on Amount

-

Input of Central Purchases will be Available

Previously on Central Purchases, CST wass charged for which no input is available

After GST, Input will be available on Central Purchases called IGST Credit.

-

Uniform Tax Rates in Different States

Previously, Rates of Vat were different form state to state

Also in some states, surcharge wass levied on this Vat

After GST, Rates will be same for all. Uniform Rates

-

Full input on Capital Goods

Previously on Capital Goods, 50% Cenvat is available in current year and 50% in next year

Also Input of Vat on Capital Goods is different from State to State

(In Delhi,it is available in 3 years while in Harayana,not available at all)

After GST, input will be available in first year

What are the important Disadvantages/Demerits/Problems in GST?

-

There are too many returns to be filed

Previously, a Vat Dealer normally files Quarterly Return for Vat (Four in One Year)

A Service Provider files Monthly Returns for Service Tax (Two in One Year)

In GST every person has to file 3 Returns Monthly

- One for Purchase Details

- One for Sales Details

- One for both Purchase and Sales

That is 36 Returns in One Year

Apart from this, there is Annual Return also, so total 37 Returns to be filed

-

Returns have become Complicated

Previously, Party wise Details not to be given for Purchase and Sales in Service Tax and Excise

After GST, giving Party wise details will be required to be given in case of GST also separately for Local, Central and Integrated GST

-

Difficult to compute

Suppose a shopkeeper sells the goods in Delhi, he currently pays only Vat

Afrer GST, he will be paying both State GST and Central GST on Same Transaction

-

IGST and not CGST on Interstate Sales

Current Tax

After GST

Within State

VAT

Within State

SGST

CGST

Outside State

CST

Outside State

IGST

-

Last Period Tax to be Paid first

Previously, if you have not paid last year tax, you can very well pay current period tax and file return

After GST,

Challan will not have period

If there is tax outstanding, it will be first adjusted against that and balance against current period

-

Concept of PLA to be Continued

Previously in Excise, there is concept of PLA (Personal Ledger Account or Account Current)

Whatever tax we pay by challan is deposited in PLA and Our excise duty liability is adjusted in it

This confusing concept is currently only in Excise and not in Vat and Service Tax

After GST, this PLA will be called Electronic Duty Credit Register and will be applicable only for all types of GST

What is Output GST?

GST on sales is called Output GST. It is also called GST Liability

What is Input GST?

GST on purchases is called Input GST.

What is GST Payable?

Output GST - Input GST = GST Payable

What is GST Credit?

If Input GST is more than Output GST it is called GST Credit.

We calculate it Separately for different types of GST

What is the procedure of Adjustment of IGST with CGST SGST Credit?

Output IGST can be adjusted with Input GST in the following order

Input IGST if any

Input CGST if any

Input SGST if any

Can CGST and SGST Adjusted Against Each Other?

CGST credit cannot be adjusted against SGST Payable.

Similarly, SGST Credit cannot be adjusted CGST Payable.

However, both can be adjusted against IGST Payable

Sequence of Adjustment

Output IGST can be adjusted with Input GST in the following order

Input IGST if any

Input CGST if any

Input SGST if any

What is the registration limit in GST?

20 Lacs

If Aggregate Turnover is greater than 20 lacs or likely to exceed 20 lacs, then Compulsory Registration

(Limit is 10 lacs for North Eastern States)

Aggregate turnover includes all types of sales

like

Taxable Sales

Exempt Sales

Export Sales

Interstate Sales

Sales by Agent of Principal (Amount of taxes not to be included)

Hence, If a person is making only exempt sales and the amount of sales is more than 20 lacs,still compulsory registration in GST

Similarly if a person is making only export sales,then also Compulsory Registration in GST

NO LIMIT OF 20 LACS IN FOLLOWING CASES

However Compulsory Registration Required for making

Interstate Sales

Supplying goods on behalf of Other Persons

Casual Taxable Person

Non-resident taxable persons

If liable to deduct TDS in GST

If liable to deduct TCS in GST

Input Service Distributor

Making Sale on Behalf of other person (Franchise/Agent)

Reverse Charge

E-Commerce Companies

Online Database Service Provider from Outside India into India

Others as may be Notified

Hence, If a person is making only exempt sales and the amount of sales is more than 20 lacs,still compulsory registration in GST

Similarly if a person is making only export sales,then also Compulsory Registration in GST

What are the Different Returns Under GST and their Due Dates?

| Form No. | Description | Due Date |

| GSTR 1 | Details of outward supplies of taxable goods and/or services effected | 10th of the next month |

| GSTR 2 | Details of inward supplies of taxable goods and/or services effected claiming input tax credit. | 15th of the next month |

| GSTR 3 | Monthly return on the basis of finalization of details of outward supplies and inward supplies along with the payment of amount of tax. | 20th of the next month |

| GSTR 4 | Quarterly return for compounding taxable person. | 18th of the month next to quarter |

| GSTR 5 | Return for Non-Resident foreign taxable person | 20th of the next month |

| GSTR 6 | Return for Input Service Distributor (ISD) | 13th of the next month |

| GSTR 7 | Return for authorities deducting tax at source | 10th of the next month |

| GSTR 8 | Details of supplies effected through e-commerce operator and the amount of tax collected | 10th of the next month |

| GSTR 9 | Annual Return | By 31st December of next FY |

| GSTR 10 | Final Return | Within three months of the date of cancellation or date of cancellation order, whichever is later. |

| GSTR 11 | Details of inward supplies to be furnished by a person having UIN | 28th of the month following the month for which statement is filed |

What are the Different Invoices Under GST?

For All types of Taxable Sales (Local or Central), Normally A Tax Invoice is to be issued

Same Series number of Invoice will start for Local and Central Sales

Same Series to be Used for Sale to Registered and Sale to Unregistered person

For All types of Taxable Sales (Local or Central), Normally A Tax Invoice is to be issued

Sale of Exempted Goods

Sale by Composition Dealer

What is the Difference Between Tax Invoice and Bill of Supply in GST?

|

TAX INVOICE |

BILL OF SUPPLY |

|

It is used for all types of Taxable Sales (Local , Central) |

It is used for all types of Exempt Sales Or Sales by Composition Dealer |

|

CGST, SGST, IGST, UTGST to be shown Separately |

No Taxes to be shown on Bill |

|

In Case of Unregistered Buyer, Name, Address State, Place of Delivery is compulsorily required if Invoice Value before taxes is more than 50000 |

No Such provision |

|

Can be Used for Both Local and Central Sales |

Can be Used for Both Local Sales in Case of Composition Dealer (as Composition Dealer Cannot Make interstate Sales) However, Exempt Sales can be made to both Local and Central Sales |

What are the Different GST PMT Forms List?

| FORM No | DETAILS IN FORM |

| Form GST PMT - 1 | Electronic Tax Liability Register of Taxpayer |

| Form GST PMT - 2 | Electronic Credit Ledger of Taxpayer |

| Form GST PMT - 3 | Order for re-credit of the amount to cash or credit ledger |

| Form GST PMT - 4 | Electronic Cash Ledger of Taxpayer |

| Form GST PMT - 5 | Challan For Deposit of Goods and Services Tax |

| Form GST PMT - 6 | Payment Register of Temporary IDs / Un-registered Taxpayers |

| Form GST PMT - 7 | Application For Credit of Missing Payment (CIN not generated) |

How to get Practical Knowledge of GST?

To learn Basics of GST, you can visit our GST page teachoo.com/gst

To learn GST Return Filing and Challans, you can take our premium course teachoo.com/premium

About the Author